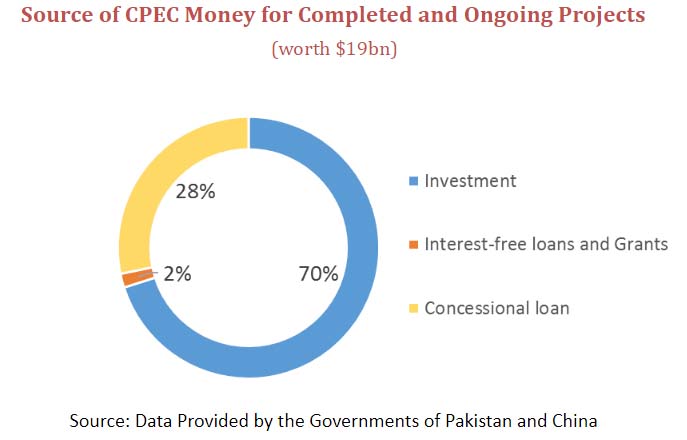

Financing Structure of CPEC

The China-Pakistan Economic Corridor (CPEC) is a $62 billion multi-sector collaboration between Pakistan and China as part of the Belt and Road Initiative (BRI). Over the last few years, CPEC has been a hot topic of discussion amongst policymakers and ordinary citizens. To enrich this discussion, the Pakistan-China Institute (PCI) has produced descriptive statistics using data from $19 billion worth of projects out of the total portfolio. The extensive details can be found in the recent monograph titled “CPEC: Where is the money going?” published by the PCI, and a shorter version published in Journal of Infrastructure, Policy and Development based at the National University of Singapore. A few highlights from this research are given below.

Financing Instruments

CPEC is composed of four different types of financing instruments. The first type is called “Investment” where the Chinese firms that are undertaking the infrastructure projects borrow commercial loans with an interest rate between 4-5% The second category is called “Concessional Loans” which are given to the Government of Pakistan at an interest rate of 2-2.5% with a maturity period of 25-30 years. The third category is called “Interest-free loans” which constitute a small proportion of the overall financing and have zero interest payments. The last category is “Grants” which are aimed at improving state capacity. A break-up of the financing arrangement in the overall portfolio and the time series of these financing instruments are given below.

Chinese Companies Involved

The research has also shed light on the companies involved in different projects in CPEC. There are nine companies that dominate the portfolio. The companies are Chinese State-Owned Enterprises that have undertaken infrastructure projects in China and other countries in the past. China State Construction Engineering is the by far the biggest contributor to the portfolio and is being financed a total of around $3 billion. The details of these companies are given below.

The main aim of this research was to inform policymakers, key stakeholders and citizens about the basic structure of CPEC. It is virtually impossible to have an informed discussion around CPEC without knowing this basic structure. Hence, it is hoped that the original monograph, along with this article will enrich the policy discussions around CPEC and solidly anchor these discussions in evidence and data.

The author is a PhD candidate at the University of Oxford and is a graduate of the Harvard Kennedy School of Government. He has also worked as a civil servant in Pakistan and tweets @KhudadadChattha (twitter.com/khudadadchattha)