Govt. to Give 10 Years Tax Holiday to Enterprises for Fast Tracking Commercialisation in SEZs

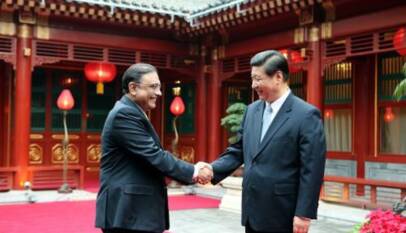

Abdul Razak Dawood, Advisor to PM on Commerce and Investment, has encouraged investors to explore business opportunities in Special Economic Zones (SEZs). Financers should invest in areas of Textile, Food Processing, IT and IT equipment, Logistics and Automobiles to get high returns on their investment. Advisor underscored the tax incentives, including onetime exemption from customs duties and taxes on import of plant and machinery into SEZs for installation in these zones. Furthermore, the government has also given tax holidays for ten years to all enterprises which will commence commercial production by 30th June 2020 in SEZs, described advisor Dawood. He said the government's strategic decision making derived to facilitate investors with cutting-edge infrastructure in Special Economic Zones (SEZs). A delegation of domestic investors called on Abdul Razak and meeting was also attended by Chairman FBR Syed Shabbar Zaidi and Chairman BOI, Zubair Gilani.

ISLAMABAD, (APP – UrduPoint / Pakistan Point News – 12th Sep, 2019 ) :Adviser to the Prime Minster on Commerce, Textile, Industries and Production and Investment Abdul Razak Dawood Wednesday said the government has taken strategic decision to facilitate investors by providing state of the art infrastructure in Sepecial Economic Zones (SEZs).

He also assured facilitation to the investors from BOI, as the lead coordination agency of Pakistan Government, said a press release issued by Ministry of Commerce here.

A delegation of domestic investors of Bin Qasim Industrial Park and Korangi Creek Industrial Park was called on Abdul Razak Dawood and they discussed various issues pertaining to taxation anomalies regarding Special Economic Zones (SEZs).

The meeting was also attended by Chairman FBR Syed Shabbar Zaidi and Chaimran BOI, Zubair Gilani.

The adviser highlighted the tax incentives provided to SEZs.

These incentives include onetime exemption from customs duties and taxes on import of plant and machinery into SEZs for installation in these zones. Moreover, he added that government has also given tax holidays for 10 years to all enterprises which will commence commercial production by 30th June 2020 in SEZs.

The adviser emphasized that beside tax incentives, incumbent government has taken strategic decision to facilitate investors by providing state of the art infrastructure in SEZs so that they could contribute in the national economy by kick starting commercial production at earliest.

During the meeting, investors raised issues relating to timely issuance of tax exemption certificates from FBR which were causing inconvenience and delays in taking investment decisions by the new investors.

In order to address this issue, the FBR chairman apprised the participants that he would nominate a dedicated focal officer in FBR who will coordinate with the investors to resolve any issue being faced in their investment ventures.

The adviser urged the investors to invest in SEZs in the priority areas which include Textile, food Processing, IT and IT equipment, Logistics and Automobiles in order to get high returns on their investment.

He stated that all the issues pertaining to taxation of various projects would be resolved and BOI would act as a single bridge between the investor and the different government departments including FBR.

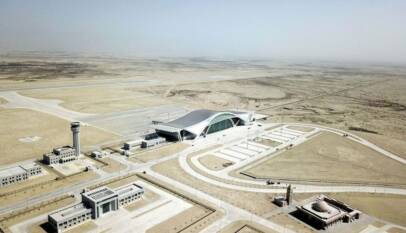

First Airbus lands at New Gwadar International Airport

ISLAMABAD, Jan. 30 (Xinhua) — The New Gwadar International Airport in Pakistan’…