Mustafa Hyder Sayed highlights the crucial role of green financing in CPEC 2.0 at Renewable Energy Summit

At a summit focused on renewable energy under CPEC, Mustafa Hyder Sayed, Executive Director of the Pakistan China Institute, emphasized the critical need for Pakistan to institutionalize green financing through a joint working group with China. He highlighted that while high-income countries are receiving green investments from China, developing nations like Pakistan often get carbon-intensive projects. Sayed stressed the importance of proactive engagement with regulators and tapping into unexplored private capital in Chinese provinces to drive market-based, green investments in Pakistan, essential for the success of CPEC 2.0 and boosting the country’s exports amidst climate challenges.

ISLAMABAD, Aug 20 (APP): The Speakers at the summit exploring financing opportunities for Chinese investors in renewable energy development under China-Pakistan Economic Corridor (CPEC) on Tuesday underscored that the next phase of the trade transit route project would revolve around green and eco-friendly investments ensuring carbon-intensive development which demands Pakistan to engage with private sector and multiple partners to tempt green Chinese investments.

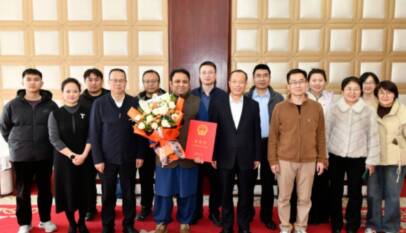

The Sustainable Development Policy Institute (SDPI) and Pakistan China Institute (PCI) jointly organised the summit on “Renewable Energy Development Under CPEC: Financing Opportunities for Chinese Private Sector”.

Dr Vaqar Ahmed, Joint Executive Director SDPI says, Chinese stakes in global RE investments were high and its stance on green investment signals for sustainable development and clean energy are providing multiple opportunities under CPEC.

He added that Pakistan required $115 billion to meet its renewable energy targets, $13 billion for replacing coal-fired projects, $30 billion for implementing wind power projects, $27 billion for rolling out electric transport and $15 billion for achieving energy efficiency.

Dr Vaqar Ahmed underlined that it provided an opportunity to the country to engage with the private sector to tap green investments that could support Pakistan’s green energy agenda through green investments.

The discussion around CPEC 2.0 encircles the discourse to learn from Chinese lessons learnt under the first phase as for the next 3-5 years CPEC 2.0 would revolve around green eco-friendly development, investments and harvesting lessons learnt from CPEC for the Belt and Road Initiative at the larger scale.

SDPI is closely working with the government on National Industrial Policy after a hiatus of two decades that was necessary amid the progressing CPEC project.

Mustafa Hyder Sayed, Executive Director PCI said Pakistan is very adversely impacted by climate change and industrial relocation was critical for boosting its exports.

He said the green transition needed to be institutionalized through a joint working group between China and Pakistan to tap green financing. Sayed said high-income countries are getting green investments from China, whereas low-carbon-emitting, developing countries in the global south were receiving carbon-led investments as the decisions were made by the host country and Chinese companies.

The countries other than China had incompatible instruments for adopting green financing parameters, however, there were certain frameworks in China like Qingdao BRI cooperation initiative for green investments outside China under BRI, he said, adding, “We need to have more proactive engagement with regulators like NEPRA and State Bank of Pakistan.

HBL is the largest Pakistani bank having a huge presence in China and is working with China on Panda Bonds (green bond investments) in China.”

He highlighted the need to work on untapped private capital in China, which was still unexplored in Chinese provinces like Fujian, Guangdong, Shenzhen etc. “CPEC 2.0 will be market-based and without a market-based approach and understanding of market trends investments will not kick start,” he said.

During the panel discussion titled “Exploring the Potential of Chinese Private Sector Investment in Pakistan’s Renewable Energy Sector” Dr Hassan Daud Butt, Senior Advisor, Energy China and former Project Director CPEC, Ministry of Planning Development & Special Initiatives said the global economic landscape had changed dramatically due to technology, trade liberalization, free capital movements, and advances in communication.

Pragmatic leadership and a strong innovative economy were critical to address headwinds as the green energy transition globally was three times higher than the five-year forecast that demanded an understanding of Chinese development and growth models to align the national agenda with it to reap the benefits of the green energy transition, Dr Butt added.

Muhammad Badar Alam, CEO Policy Research Institute for Equitable Development (PRIED) said energy projects required land and environmental impact assessments (EIA) a provincial government’s mandate that demanded the federal government and implementing partners to devolve power-related functions to subnational level as the projects fail that lacked provincial governments ownership.

In a panel titled, “Growth of RE Industry Under the SEZs of CPEC: Potential and Opportunities”, N A Zuberi, Senior Advisor, China Three Georges South Asia Investment Ltd said the SEZs were designated areas in Pakistan having additional facilities and lucrative benefits to local and international industrial investors that were in all parts of the country with tax incentives, infrastructure support, and simplified procedures for investments.

“Relocation for the Chinese solar panel industry is a lifetime opportunity for Chinese and Pakistani investors due to abundant raw material, cheap labour, SEZs, Board of Investment (BOI) one window facility and other benefits,” he said.

The government of Pakistan should promote SEZs’ incentives at a significant pace like highlighting 10-year income tax holidays and one-time exemption from all customs duties and taxes on imported goods with cost advantages, stable and predictable policies, engaging in continuous dialogue and simplifying processes to garner Chinese investors’ interest.

China charts new growth path as ‘Two Sessions’ launch 15th Five-Year Plan era

BEIJING: China signalled a new phase in its economic strategy as the country’s top legisla…