Pakistan likely to get $6.3 billion rollover of China debt

In a major development, China will likely to rollover Pakistan’s $6.3 billion debt after Islamabad officially requested Beijing during the recent visit of PM Sharif.The development came to light after a recent Chinese visit by PM Shehbaz Sharif, in which he held meetings with the Chinese president and the premier. In addition,China will consider the rollover of Pakistan’s debt and the decision is expected in the upcoming few months. Pakistan is looking forward to rollover its Chinese loan of $6.3 billion until June 2023.

ISLAMABAD: In a major development, China will likely to rollover Pakistan’s $6.3 billion debt after Islamabad officially requested Beijing during the recent visit of PM Sharif, ARY News reported, citing well-placed sources.

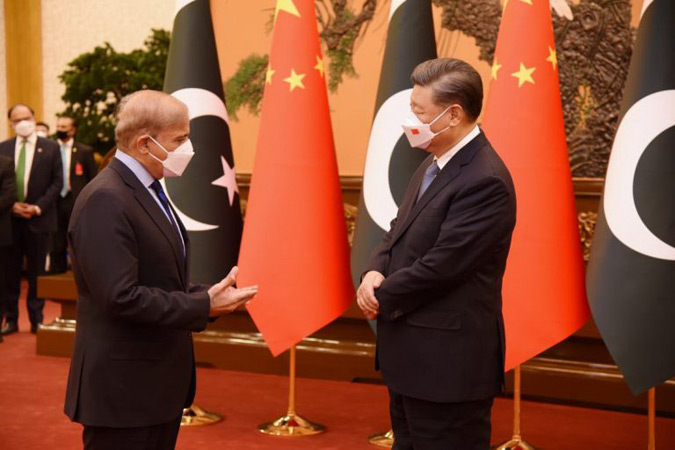

The development came to light after a recent Chinese visit by PM Shehbaz Sharif, in which he held meetings with the Chinese president and the premier.

The sources say China will consider the rollover of Pakistan’s debt and the decision is expected in the upcoming few months. Pakistan is looking forward to rollover its Chinese loan of $6.3 billion until June 2023.

Earlier, the issue of rollover and refinancing of nearly $6.3 billion in commercial loans and the central bank debt was also discussed in a meeting between Chinese Ambassador to Pakistan Nong Rong and Finance Minister Ishaq Dar.

Pakistan has already obtained $2.2 billion loans during the July-September quarter while Saudi Arabia has also announced to rollover $3 billion debt maturing in December this year.

The deposit was to mature on Dec. 5, but that has now been extended to next year, the State Bank of Pakistan said on Twitter.

It is pertinent to mention here that the deposit agreement between Riyadh and Islamabad was signed in November, last year. Under this deposit agreement, the Saudi Fund for Development (SFD) placed a deposit of $3 billion with SBP.

China to deepen high-quality development, expand opening-up as ‘Two Sessions’ convene

BEIJING: China will continue to promote high-quality development and expand high-level ope…