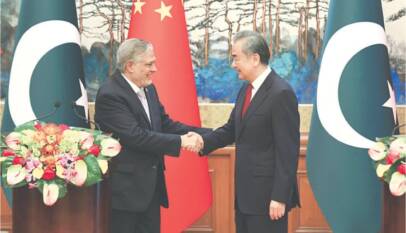

PM Khan’s China visit to reinforce strategic ties

Syed Ali Imran, a Corporate Finance Specialist writes that Prime Minister’s visit to China will give new strength to Pak China relations where Pakistan stood with China when the western world has boycotted the Winter Olympics diplomatically. He mentioned that this was PM Khan’s fourth visit to China during his tenure of the last three years. Pakistan not only showed its concern over CPEC-based IPP agreements where overdue receivables are touching Rs 250 Bn but seek support in the shape of a soft loan to stabilize its external account. It is pertinent to mention here that China has already given USD 11 Billion in the shape of commercial loans and foreign exchange reserves support initiative including $4 Billion in SAFE deposit. 21 different sectors identified with Chinese business leaders related to Special Economic Zones under the CPEC, IT, agriculture together with the relocation of Chinese industries to Pakistan.

International Monetary Fund (IMF) has approved a $ 1 Billion tranche after completing its 6th review. For the approval of this latest assessment, it took several months and so many harsh unpopular measures by the government to satisfy IMF conditions. Now it paved the way to get more foreign exchange from the issuance of bonds and some grants from other international financial institutions. With this positive news and inflow of dollars, Rupee gained its value in the open market. IMF further believes that market-driven exchange rates and good macroeconomic policies will address external account issues in long run. Governor State Bank (SBP) stated that Pakistan is now on such a growth track, which is according to economic principles and is sustainable however claimed Inflation as a global challenge. He further added that the Tax to GDP ratio needs to be increased and for such reason, several measures are undertaken. The government approved Rs 4 Billion for the Federal Board of Revenue (FBR) system upgradation and asked Exchange Companies (EC), the largest source of Foreign exchange (FE), to integrate with FBR where EC to surrender 100 per cent home remittance against Rs 1 per USD benefit. Prime Minister Imran Khan, in the meantime, went to China on the inaugural session of the Winter Olympics where the Russian President was also there with a planned meet-up. Such a move of Pakistan has given a clear stance of our foreign policy where the western world has diplomatically boycotted the Winter Olympics being held in China. PM also assured China about his government’s affirmation to pace up the projects under China Pakistan Economic Corridor (CPEC) and tried to renegotiate tariffs related to CPEC power projects together with trade agreements which previously were not well articulated.

It is not the first time Pakistan went to the IMF. Initially, Pakistan, through a standby agreement, knocked on the IMF’s door first time on September 22, 1959. However, the first borrowing was made on March 16, 1966, with USD 38 Million. The longer period when Pakistan stayed away from IMF was post 911 during the Musharaf era when probably due to being a part of the War on Terror as front line state, the inflow of US dollars and larger Foreign Direct Investments into the Telecom sector stabilized the external account of Pakistan for some seven years.

However, due to a restricting exchange rate, the biggest-ever borrowing agreement with IMF was made on September 30, 2011, with an agreed amount of USD 7.2 Billion with the drawn amount of USD 4.9 Billion followed by an Extended Funded Facility of USD 6 Billion agreed in July 2019 in tranches with some harsh conditions of time-bound assessments and to release facility amount in tranches after completing these assessments religiously. Due to the COVID-19 outbreak, the release of tranches was stopped. But the IMF released USD 1.4 Billion in April 2020 to support Pakistan, which came under supporting loans to virus-affected economies. Hafeez Sheikh, the then Finance Minister, completed the third, fourth, and fifth tranches and was replaced by Shoukat Tarin, who was initially not in favour of raising power tariffs and other harsh measures. However, due to rising external account concerns, Pakistan re-entered the IMF program and took some real harsh measures by passing the mini-budget to withdraw Rs 378 Billion tax exemptions and approving the SBP autonomy Bill. Now, the tranche is released and Pakistan is looking forward to a sizeable gain in the PKR value in the short-term unless, within the time range, it may rationalise a real effective exchange rate by controlling over-inflation and reducing the trade deficit. In this regard, the good news is from the textile industry where the sector can grab regional export orders.

The textile industry has posted an increase in export by 26 per cent in the first half of the fiscal year 2022 (1HFY22) i.e. exports reached USD 9.4 Billion. However, it is pertinent to mention here that textile exports of Bangladesh for the same period have increased by 28 per cent. This shows the orders are coming from the West where regional competitors are also well aware of and deep down relationship strategy to deploy not only private to private clientele but through diplomatic means a need of the times. Now after SBP autonomy, fears are there to the textile industry, where the sector is largely dependent on short-term and long-term subsidized financing from SBP. No matter what the outcome may be for subsidised borrowing, another challenge related to the cost of energy is there as well where either input cost is increasing in the shape of fuel or tariff is being rationalised by accounting for input cost and rising circular debt which is increasing at a pace of Rs 38 Billion per month. The present circular debt level is increased to Rs 2.476 Trillion. According to the new Rs 3.09 per unit, the increase is approved by NEPRA for DISCOs for fuel adjustment for December 2021, which will increase the further burden. Please note that due to ill-planned agreements with IPPs of then government appreciation in USD leads to more burden on Government to pay against capacity payments though the present government has successfully abled to reduce this burden to some extent however the damage has been done.

Prime Minister’s visit to China will give new strength to Pak China relations where Pakistan stood with China when the western world has boycotted the Winter Olympics diplomatically. This is PM IK’s fourth visit to China during his tenure of the last three years. Pakistan not only showed its concern over CPEC-based IPP agreements where overdue receivables are touching Rs 250 Billion but seek support in the shape of a soft loan to stabilise its external account. It is important to highlight here that China has already given USD 11 Billion in the shape of commercial loans and foreign exchange reserves support initiative including $4 Billion in SAFE deposit. 21 different sectors identified with Chinese businesspeople related to Special Economic Zones under the CPEC, IT, agriculture together with the relocation of Chinese industries to Pakistan. We expect a good outcome from PM IK’s visit to China where the Russian President was also there in favour of external accounts otherwise another IMF program will be awaited.

Ambassador Zaidong highlights China’s embrace of innovation for sustainable development in Pakistan partnership

In recent months, the term “new quality productive forces” has sparked intense discussions…